Effective tax rate formula

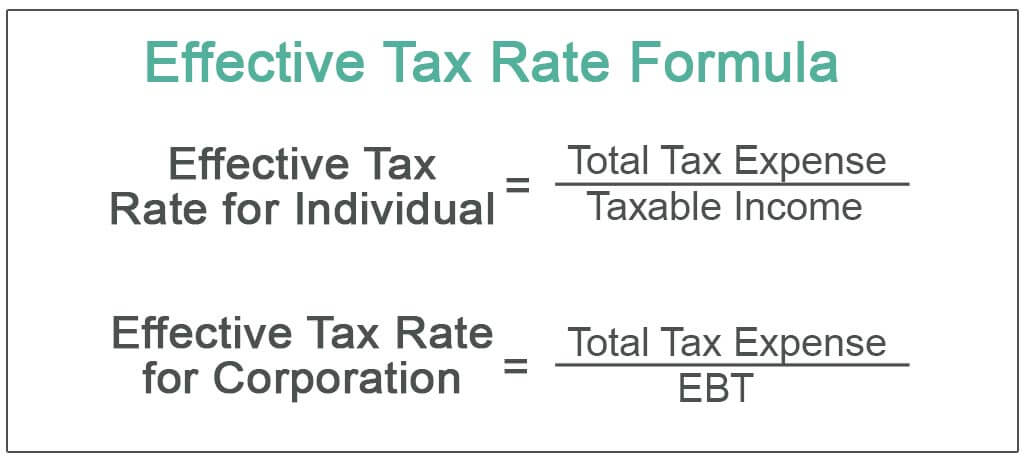

The effective tax rate is the rate which would be paid by a taxpayer on his tax if it was charged at a constant rate rather than progressive. In the above case the tax rate applicable to.

Effective Tax Rate Definition Formula How To Calculate

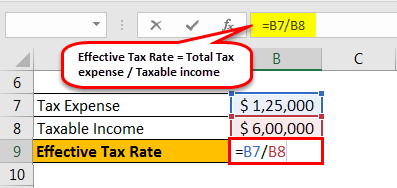

Heres the formula.

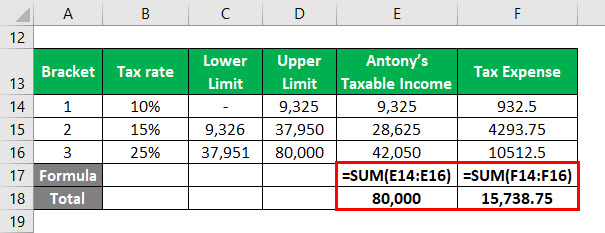

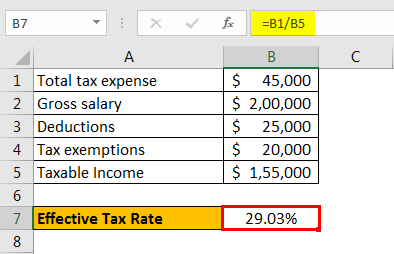

. Individual A reports a taxable income of 450000 and Individual Xs taxable income is 380000. Effective tax rate 19582 120000 1632. The effective tax rate can then be calculated using the following effective tax rate formula.

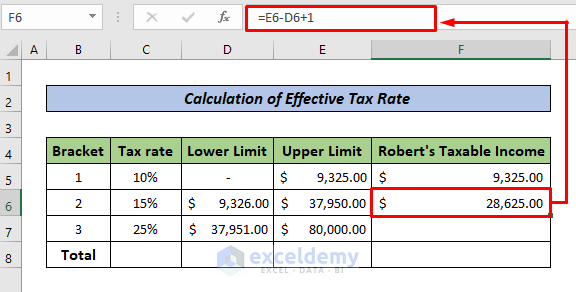

Effective tax rate calculation example. This simple procedure can be. Putting it other way the effective tax rate is the.

What makes effective tax tricky is that two people in the same tax bracket could have different effective tax rates. Read this blog post to learn more about effective tax rates. In addition the average corporate effective tax rate is much lower due to.

It averages the amount of taxes you paid on all of your income. The effective tax rate formula is simple and requires three pieces of data that are generally available online. That gives us the formula.

To compute the after-tax operating income you multiply the earnings before interest and taxes by an estimated tax rate. More on effective tax rates. Marks effective tax rate equals tax payable divided by total income.

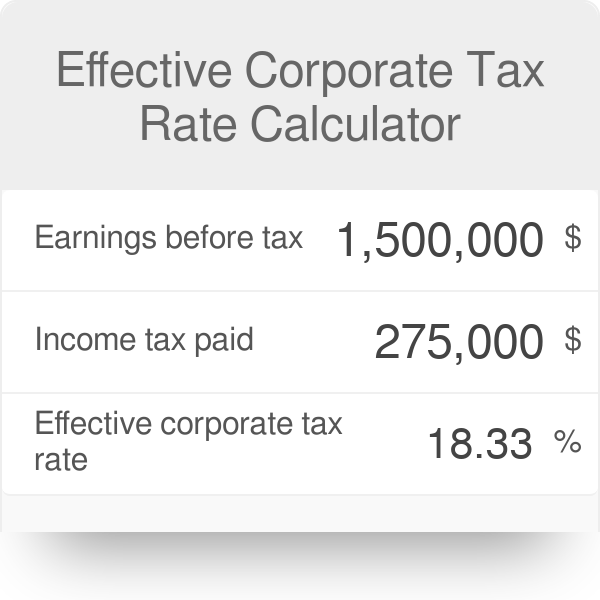

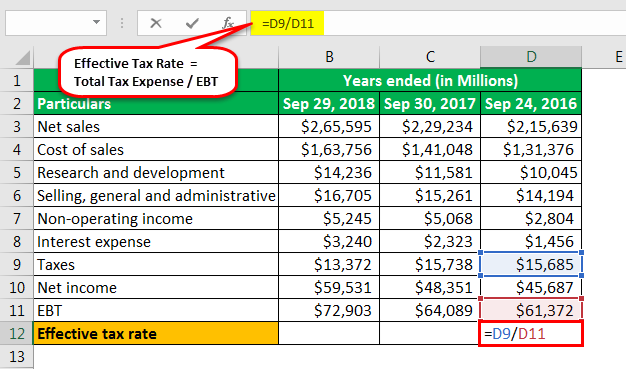

Effective Tax Rate ET Taxes Paid Taxable Income. Consider the following scenario. Effective Tax Rate Income Tax Expense Earnings Before Taxes EBT For instance in fiscal 2014 Google reported an income tax expense of 3331.

Someone who earns 80000 would pay. The effective tax rate is the average rate at which an individual is taxed on earned income or the average rate at which a corporation is taxed on pre-tax profits. In our example above Steve would have paid about 12358 in taxes on his 2019 income.

3 To calculate this rate take the sum of all your lost income and divide that. For example in 2020 a single filer with taxable income of. Your marginal tax rate or tax bracket refers only to your highest tax ratethe last tax rate your income is subject to.

Next lets apply a simple numerical example to. This effective tax rate represents the percentage taxes paid after accounting for all tax breaks. Therefore the effective and marginal tax rates are rarely equivalent as the effective tax rate formula uses pre-tax income from the income statement a financial statement that abides by.

Your effective tax rate is different.

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

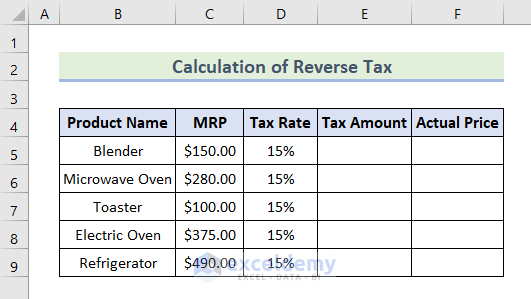

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Effective Tax Rate Definition Formula How To Calculate

How To Calculate Federal Tax Rate In Excel With Easy Steps

Effective Tax Rate Definition Formula How To Calculate

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Effective Tax Rate Formula Calculator Excel Template

Excel Formula Income Tax Bracket Calculation Exceljet

Effective Corporate Tax Rate Calculator

Cost Of Debt Kd Formula And Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula And Calculation Example

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula And Calculation Example

Net Operating Profit After Tax Nopat Formula And Calculator Excel Template